Women’s Work and the Case of the Missing $6 Trillion

When I joined Reset Your Nest in 2022, founder Jen Martin and I committed to building a business that centered our company’s purpose on the financial success of our employees while creating a national footprint. Over the past two years, we tried multiple growth strategies and, through deliberate test-and-learn efforts, built a thriving team and business.

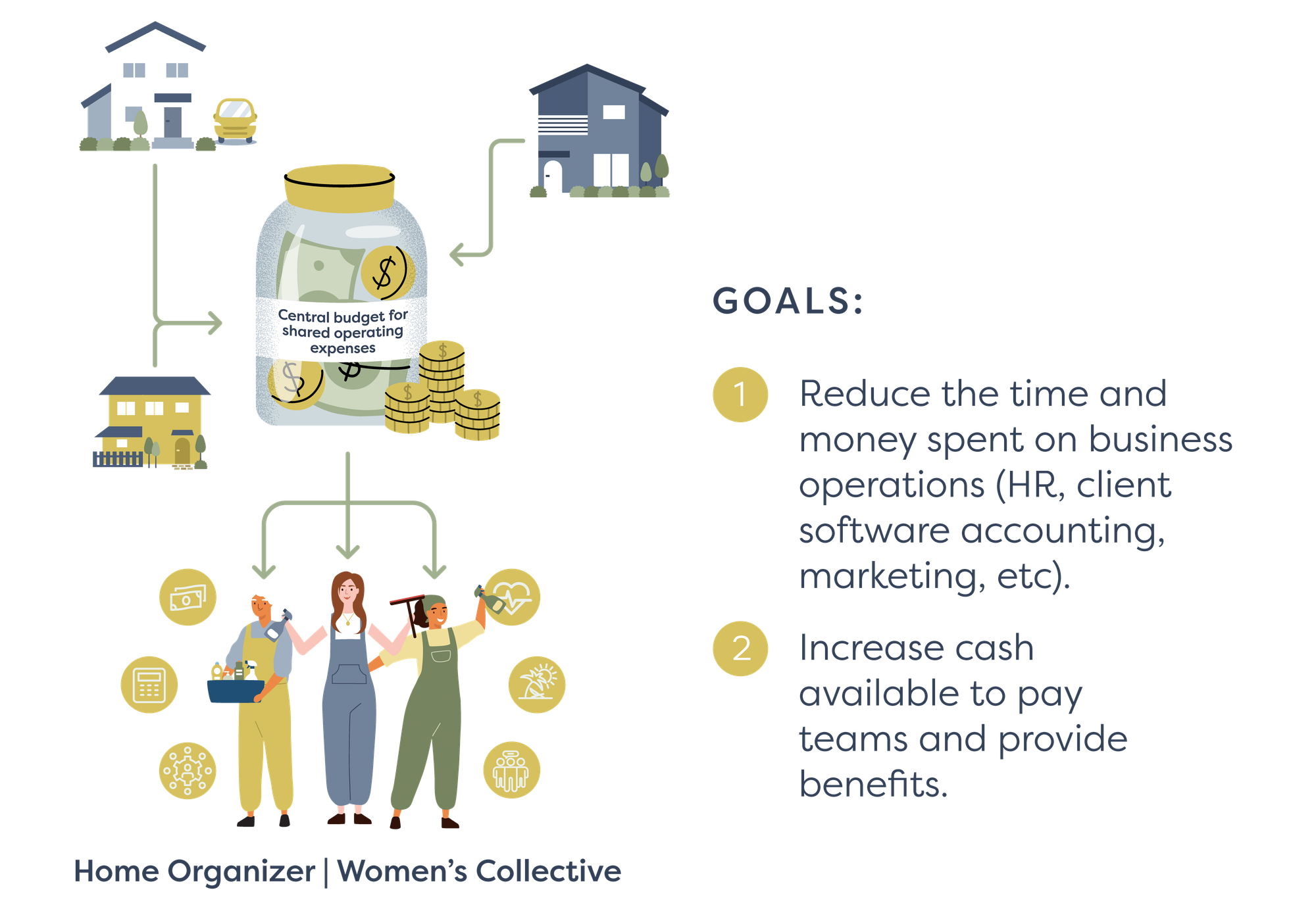

During this time, I was lucky to work with Jen and later with Stephanie Sikora, the founder of Sikora Solutions, to imagine how we could build a national collective of women supporting and championing one another in the newly forming industry of home organizing. I expected changing systems to be challenging, but I also anticipated investors to embrace our compelling vision of women building a collective to fairly compensate and distribute the labor of home organization at lower administrative costs—to say nothing of home-organizing business owners tired of trying to do it all (accounting, payroll, customer relations, marketing) just so that they can do the thing they love: work with clients and organize homes.

I’m so proud of the team we built and grateful for my time working with Jen Martin and Stephanie Sikora, both visionary entrepreneurs with hearts of gold. While we were not able to realize that new system, they have thriving businesses that are profitably working within the existing system. Reset Your Nest and Sikora Solutions are outstanding women-owned companies worth celebrating and supporting.

For now, we've shelved the idea of a national collective, and I am beginning to consider my next career opportunity. Looking back on the last two years, it has been helpful to consider the systems that make it easy for women to start “small businesses” and thrive in local and existing markets, but that fail to imagine new systems and beliefs that would need to exist for these ideas to grow beyond local operations. I believe the lessons we learned are transferable to dozens of service-based, women owned small businesses and want to begin considering what would need to change for founders to achieve much greater economic returns.

What would a Collective Business Model look like?

What surprised me most were the immutable assumptions within our normalized systems. We hoped that we could convince other small business home organizers or investors of a more profitable model predicated on all of us working together. Unfortunately, we regularly struggled to dispel two fundamental systemic beliefs: 1) home organization is something that individuals, not communities, do, and 2) housework is unskilled, low-wage labor. I could not find a lever to galvanize enthusiasm for systemic change among our communities of either small business owners or female impact investors.

Valuing work traditionally done by women is always a choice.

Time after time, I heard the socialization of women play out in conversations around home organization. Assumptions that were flat-out wrong were challenging to displace, including:

- Home services must be a low-cost market.

- These services only benefit white women.

- Small business owners are financially “safer” if they remain independent.

- Too many women working together is toxic; women work best alone and in control.

Having homes that are organized and operate well benefits everyone in society. Living in a functional home has broad impacts, including reducing employee burnout, improving individual happiness, and benefiting productivity. Yet, the cognitive labor of creating home systems and improving both functionality and beauty is most often categorized as “women’s work,” and it is work that is expected to be done for free rather than financially valued.

I wish we had moved our financial conversations with founders and investors from what exists in the market to what is possible.

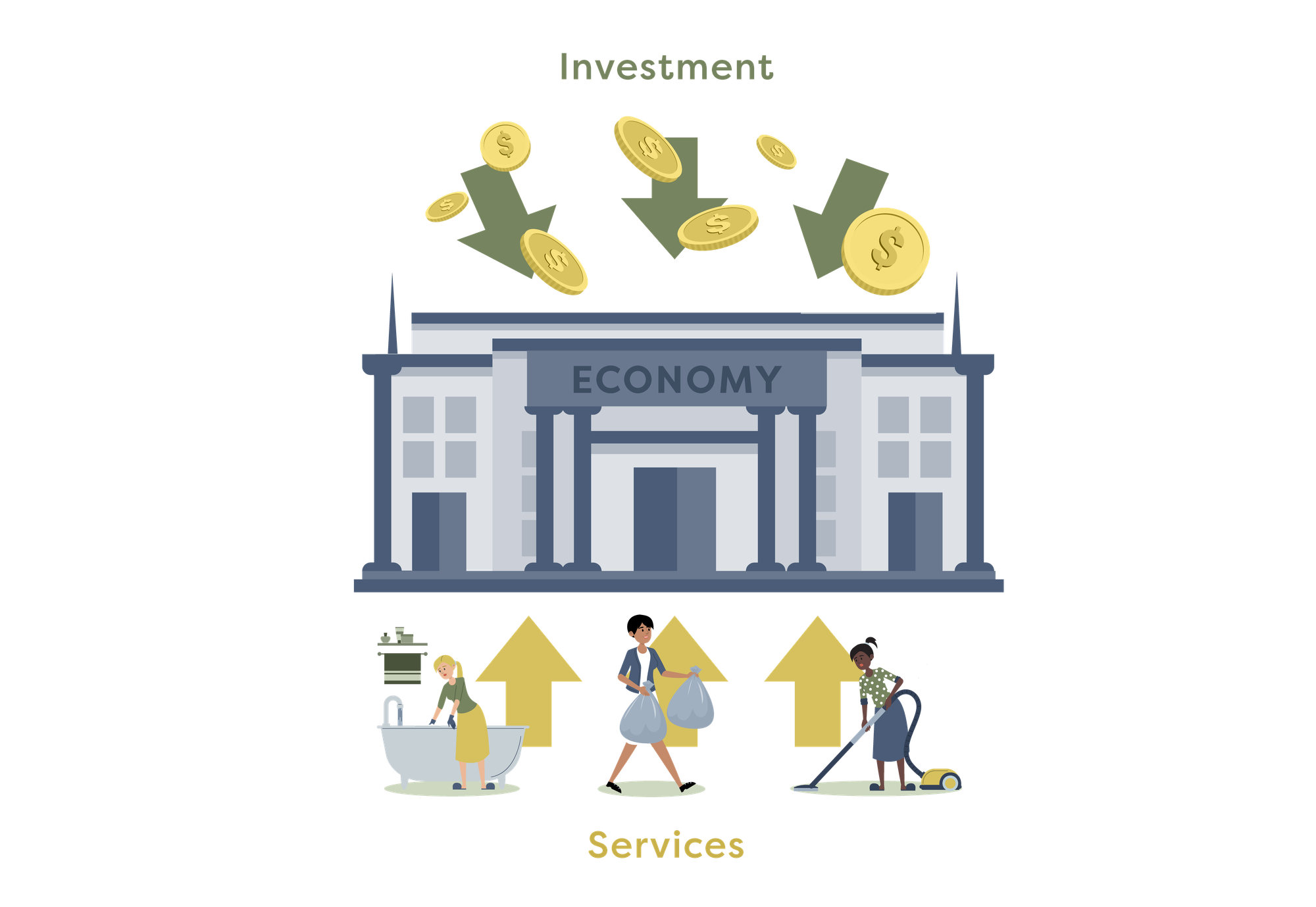

Using the past systems of what exists in the labor market limits the opportunity to imagine what could be possible for service businesses. We lack an end-to-end ecosystem value of work traditionally done by women, and it results in minimizing the far-reaching effects. How might we revalue these services or scale backend tasks in collective models?

Unfortunately, my storytelling about what would be possible if women collectively banded together rather than individually offering services was not compelling enough to ignite other small business owners to join us, and it didn’t raise the catalyst funds we would have needed to simply buy our way into the markets with cash offers to the business owners.

In a catch-22 system, we have financial frameworks for evaluating an investment predicated on an economic practice established over 100 years ago. These ways of working result in ongoing systemic gaps preventing wage, wealth, and work equity for men and women. Our financial systems will struggle to evolve and close gender gaps that disproportionately impact women at every level of our economy until we can imagine new economic models that value women’s labor, reconsider the economics of service-based work, and reward collectives over individuals.

Specifically, we need new financial models to understand our economy's investment opportunities for care.

I think about care in all of its forms, including the care of people, apartments and homes, and neighborhood communities; and the labor performed by often low-paid professionals, including nurses, home aides, educators, and childcare providers. This includes hair and nail stylists, waxing studios, salespeople at clothing boutiques, and massage therapists. The chart below comes from American Progress and shows the occupational segregation of women in the United States work force.

This matters, because half of the gender wage gap (and the resulting gender wealth gap) can be attributed to occupational segregation. In other words, the way we are valuing the time and work that is done by women.

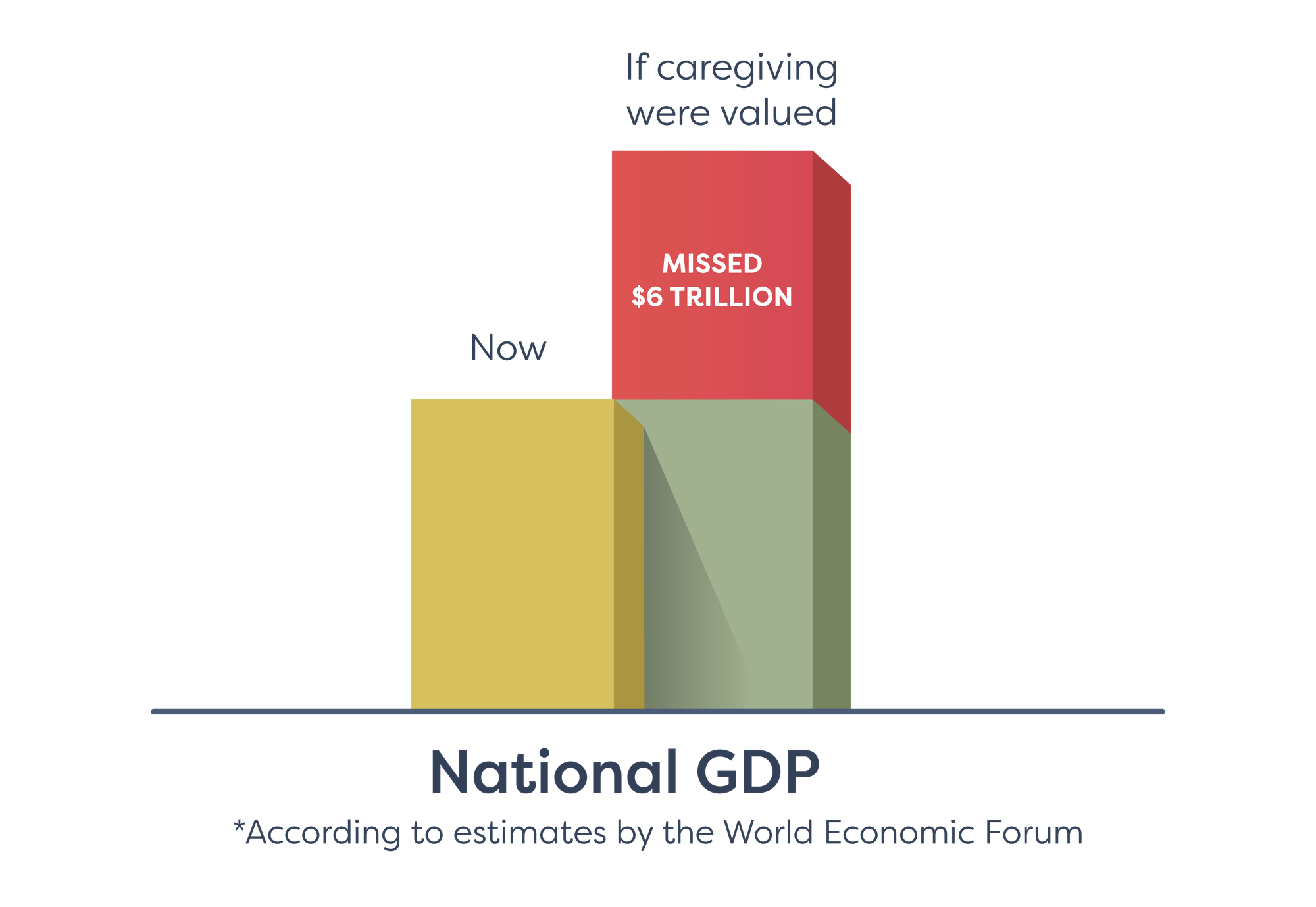

To help our economy thrive, we need a wide array of new, innovative businesses created by women, employing women, and with women’s needs in mind. Expecting women to provide care at low hourly wages or for free deprives our economy of up to 6 trillion in GDP, according to estimates by the World Economic Forum. It weakens our progress toward gender equity and shared division of work within households and throughout communities.

New businesses might emerge if we stop requiring women to personally hold the responsibility of care and instead create accountable communities of care. I often wonder how different the investment conversations and outcomes would look if, rather than evaluating an investment through the lens of “Does this issue or opportunity matter to me?” an investor had asked, “Does this issue or opportunity matter to you?” From there, partnerships could be built to creatively galvanize market capital and imagine profit through new, more equitable systems of wealth creation.

Furthermore, savvy investors should consider artificial intelligence's rapid changes and diversify their portfolio with manual labor that will remain viable much longer than those still hunting for SaaS deals. (Software as a Service) returns that artificial intelligence and automation will easily replace.

There is a material impact for every woman in our society who is overlooked and every culture-changing idea that could improve the lives of women that go unfunded. Not every idea will be successful, but we need considerably more bets. What is preventing you from imagining and investing in a cultural revolution?

Resources for investing in a more equitable future

Along the way, I have gathered several resources that I hope might be useful to others interested in creating new and more equitable market dynamics.

The power dynamics that determine everything from who has the money to write investment checks (top of the market) all the way to home finance decisions about whether services traditionally performed by women are “worth it” (bottom of the market) exist because of broken systems of oppression that hinder our imaginative opportunities. We need new decision lenses and more creative business models to organize a more equitable economy.

Frameworks

For investors interested in unlocking new and more powerful forms of wealth, we start with new frameworks to evaluate and measure gender lens investments.

The Criterion Institute created a framework that is rewriting how deals are made for gender equity.

2X has created 6-dimension framework to consider whether an investment truly helps women in the value chain using a gender lens to define the opportunity

Iris+ is a tool created by the Global Impact Investing Network (GIIN) to help investors sort and select investments that match their desired areas of impact.

Platforms

From a money management perspective, I’m partial to Ellevest for all women+ investment topics, but I also like Ethic and am happy to share that even they have partnered.

One of my current favorite platforms is PlayMoney, an Angel Investment Network that lowers the barriers to participating in funding startups. It is built by women, for women, and I am so excited to see how they grow!

Publicly traded groups of stocks

At a stock and fund level, there are several stocks created, often with the frameworks above, to invest in groups of companies that promote gender equity as part of their social mission. I’m sure there are more—if you know one, please let me know and I’ll add it to this list!

JSTC ETF (an exchange-traded fund) offered by Adasina Social Capital

SHE index fund created by SSGA.

Private Investment Groups Investing in Women

How Women Lead has a group called The Table where you can find a list of companies and people committed to gender investment.

Here is a list of almost 70 funders who do early and seed funding that I compiled while preparing to seek funding. I don’t know how many of them are actively writing checks, but these were the funds that appeared to be open to hearing from early-stage founders with good ideas.

Nonprofits and foundations raising issues of care and gender equity

National Domestic Workers Alliance

Gates Foundation (strong support of Pivotal Ventures)

National Partnership for Women & Families

Organizations of Women Supporting Women

These lists are just a start. I’d love to hear from my friends!

Who do you know who envisions an equitable society for men and women?

What frameworks, platforms, investments, products, and services are they championing?

How are you imagining better and taking action?

Please share!