Are the policies at Silicon Valley Bank sexist?

Here’s my experience.

In May I wrote about how critical care work is to the US economy and about the gaps in our systems in terms of how we value the work that happens in homes and the caretakers who do that work.

Since then, my company has finalized our registration as a C-corporation. My first two tasks as CEO seemed fairly straightforward—registering as a corporation and getting a checking account. Thousands of startups have done it, and I was excited to be one of them. Once the registration came through for our corporation, I thought the checking account would be easy. The day after we were issued an EIN number, I wrote my application to Silicon Valley Bank, ready to move forward.

I applied for an account with SVB for a number of reasons: They have a network for startups, they’re located near where I live and work, I previously worked for a startup that had a good experience with them, and I was impressed by their values and stated commitment to gender equity. The bank has an entire section on their website that focuses on expanding access to innovation by “Advancing women, Black and Latinx individuals to positions of influence.”

My application was denied. On May 25, the bank sent me this note:

Hello,

Thank you for reaching out. SVB overall works with technology companies from inception through late/public stage that have raised or are raising venture capital funding.

Typically, these companies have proprietary IP in the sectors of software, hardware, life science/biotech, and clean tech, as well as some level of institutional backing.

Unfortunately, we would not be able to extend our banking services as it appears the company falls outside the scope of our niche focus. However, if you feel we’ve misread your company’s platform, please feel free to reach out.

Best,

Team SVB

Earlier in my life, this would have felt personal. After working in the fintech industry for 20 years, I know better.

An algorithm or perhaps someone from their team likely followed a checklist review.

- Does this look like a “technology” company?

- Do they fit in our “niche” and defined sectors of “software, hardware, life science/biotech, and clean tech”?

- I read the reference to institutional banking as, “Do they have money?”

While SVB’s mission may be to “expand access to innovation,” they have demonstrated that their values and policies are clearly and deeply at odds.

Nothing about “software and hardware” is a niche industry. It’s been over a decade since Marc Andreessen famously declared that “software is eating the world.” What industry doesn’t have the potential to be eaten by software? Sadly, the software appetite, as it were, began within industries that were easy and profitable. It has gone on to fix the problems most experienced by men, as I wrote in my last post.

Silicon Valley Bank has goals to support founders and connect them with a “vast network within the innovation economy.” But where is that progress?

- How many founders are women, Black, or Latinx?

- How many of the companies allowed to bank with SVB are serving the most critical needs of the underrepresented groups that they claim to be advancing?

- How many applications get denied, and what are the intersectional demographics?

We need more companies to LIVE the values of diversity, equity, and inclusion and work harder to change the systemic barriers that exclude and undervalue the very people they claim to “expand access” for and ”include.”

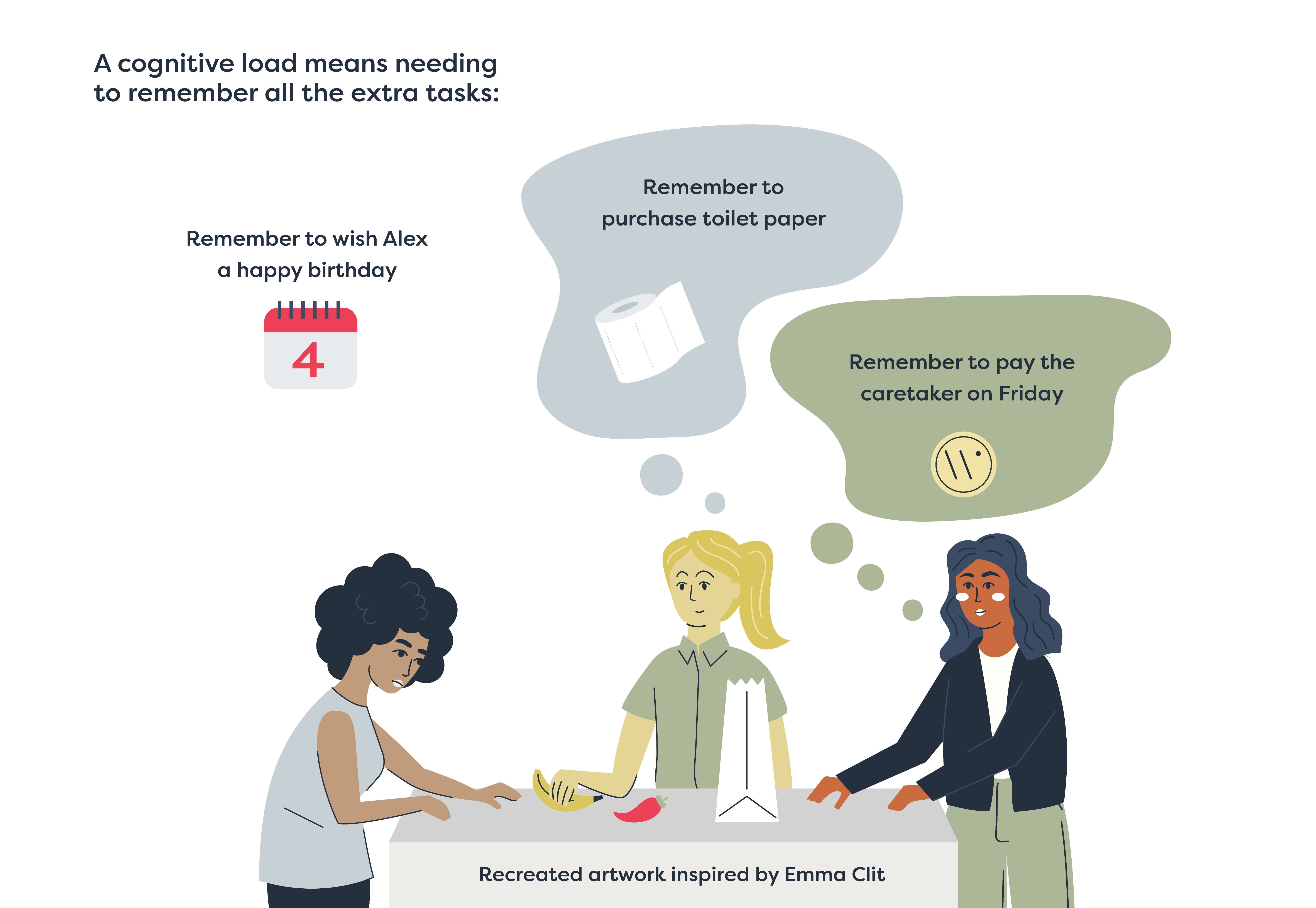

Organizing and maintaining a home is an extremely common activity. Men and women don’t share these responsibilities equally. Home organizing has largely been seen as an activity by women, for women, with little thought to how technology could innovate and change the cognitive load required to keep a home clean and well-stocked.

SVB reviewed our application and the banker (or algorithm) that reviewed the request determined that Reset Your Nest “falls outside the scope of our niche focus.” I’ll be honest, I was shocked to read the rejection email.

Please note: I did not apply for a small business loan. I applied for a business checking account where we could store our existing investment funds.

There is almost no risk in this application. I was rejected by a bank that claims to be specifically focused on startups and touts their diversity efforts for the “opportunity” to store four hundred thousand dollars with their bank.

It’s a real awakening that spending time to innovate for the betterment of our homes is going to be a slog at every step along the way. Work done inside the home is discounted before we even finish saying the words “home organizing.” Women have had the right to open a bank account since the 1960s—but they and their companies can still be denied for doing “women’s work.”

I recognize that I’m in an uphill battle, but until the fabric of how decisions are made, and the data used to make those decisions is carefully re-examined, it is pointless to expect different, more equitable results.

I immediately reached out to SVB and asked them to reconsider my application. More than a month later, I have not heard back. An activity that should have taken me no more than half a day—setting up an account and transferring funds—has taken weeks.

If you work at a company that has a diversity, equity, and inclusion program and your team has not reviewed your policies and outcomes to understand what individuals and businesses you are denying, please do so.

Running the same biased playbooks with biased data and relying on the same biased systems will result in the same bullshit, biased outcomes. Let’s move beyond talking about change and posting initiatives on websites. Be the change. Start by examining applications and operating systems to ensure that you don’t exclude the very businesses that depend on you for access to play the game. Take it a step further and look at your outcomes to see if you have intersectional representation with diverse backgrounds, and evaluate your clients to confirm you are serving diverse communities.

Today, I am deeply grateful to be starting a business with a social mission to value the care economy in 2022. I want to recognize and thank the female financial giants who are opening doors and creating systems of wealth for women and within the economies where we operate.